Brico Closes Series A to Set New Standard for Financial Licensing

AI-driven regulatory automation company raises Series A within a year after seed round as existing investors double down on explosive 600% growth

SAN FRANCISCO, CA, UNITED STATES, October 23, 2025 /EINPresswire.com/ -- Brico, the AI-powered platform automating state and federal licensing for financial institutions, has raised $13.5 million in Series A funding led by insider Flourish Ventures, with strong participation from existing investors Restive Ventures and Pear VC. The rapid fundraising – completed within a year after Brico’s seed round – reflects investor confidence in the company’s AI-first approach to solving one of financial services' most persistent bottlenecks.

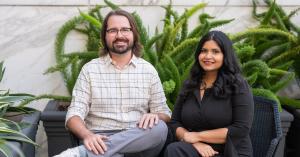

Founded in 2023 by industry veterans Snigdha Kumar and Edward Swiac, Brico has emerged as one of the fastest-growing companies in regulatory technology, posting 600% year-over-year growth and earning recognition as one of Forbes’ Top 50 FinTechs of 2025. Brico helps financial companies get licensed and launch products faster and cheaper, using intelligent automation to transform the complex, state-by-state licensing process that payments, Crypto, lending, and mortgage companies need to operate legally.

Licensing has long been the first and often most daunting barrier to launching new financial products. For decades, the process was slow, expensive, and reserved for the best-funded companies, with law and consulting firms charging millions just to apply. Brico is rewriting that story, transforming licensing from a gatekeeper into a growth enabler. By combining intelligent automation with deep regulatory expertise, Brico enables companies to cut costs by up to 90%, complete applications five times faster, and bring new products to market with unprecedented speed and confidence.

“Financial licensing is the invisible backbone of innovation in fintech, and until now, it has been the industry's biggest bottleneck," said Snigdha Kumar, CEO and Co-Founder of Brico. "Companies are shifting from third-party models to owning their own licenses for greater control, scalability, and trust. We’re building the modern platform that makes license ownership fast, affordable, and joyful, empowering Payment, Crypto, Lending, and Mortgage providers to launch and expand with confidence. The fact that our existing investors doubled down and we closed this round so quickly after our seed demonstrates the massive market opportunity we’re capturing.”

Brico’s intelligent platform automates the entire licensing lifecycle from applications to renewals, pairing AI-powered automation with human-in-the-loop compliance experts. The company's proprietary AI models continuously learn from regulatory changes across all 50 states, automatically adapting forms and requirements. The result: customers complete applications 5x faster, cut licensing costs by up to 90%, and reclaim 75% of their team’s time from tedious tasks like form filling, tracking changes, and managing filings.

Since launch, Brico has earned the trust of top-tier companies, including Marqeta, Bilt, BitGo, and Tilt (f/k/a Empower), who rely on Brico to manage complex, multi-state licensing portfolios spanning Money Transmitter, Lending, Collection, Mortgage, and even New York BitLicense.

“Every company that touches money faces the same painful licensing maze, and Brico finally cracked the code,” said Kabir Kumar, Founding Partner at Flourish Ventures. “Brico is establishing the new standard for financial licensing, transforming a major operational burden into a source of speed, trust, and scalability. Their growth trajectory has been exceptional. Hence, we doubled down on Brico.”

The new funding will accelerate Brico’s vision, expanding license coverage, launching predictive compliance tools, and building licensing agents to handle regulatory workflows. The company also plans to double its team over the next year to meet surging customer demand.

About Brico

Brico is the modern AI-powered regulatory platform for financial institutions and fintechs. Its real-time intelligence engine continuously monitors requirements and deadlines across all 50 states, automatically flagging changes and centralizing data into a single source of truth for compliance operations. The platform automates licensing, renewals, and ongoing compliance management, helping companies stay compliant faster, more affordably, and with greater confidence. Founded in 2023 by industry veterans Snigdha Kumar and Edward Swiac and headquartered in San Francisco, Brico is trusted by leading brands including Marqeta, Bilt, BitGo, and Tilt (f/k/a Empower).

About Flourish Ventures

Flourish Ventures is an $850M global early-stage venture firm that backs entrepreneurs transforming financial systems for the better. We believe the most valuable fintech companies solve foundational challenges—expanding access, improving products, lowering costs—allowing people and businesses to thrive. Flourish’s global portfolio spans over 100 companies across the U.S. and emerging markets. Current investments include unicorns such as Alloy, Flutterwave, Kin, Neon, and Unit, alongside frontier innovators such as Akua, Brico, Crossmint, Fuse, Reserv, Spade, Stitch, Swap, and Vidyut. The firm also champions entrepreneurs shaping policy, media, and research to accelerate lasting change in financial services. Our evergreen structure enables us to back long-term trends with conviction. Notable exits include Brigit (acquired by Upbound Group), Chime (NASDAQ: CHYM), GrabFinance (NASDAQ: GRAB), Mantl (acquired by Alkami), SeedFi (acquired by Intuit), and United Income (acquired by Capital One).

Laura Handy

Brico

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.